APUBCC Bulletin #5

Welcome to our June 2025 edition of our APUBCC Bulletin #5, where we dive into the latest advancements in decentralized finance (DeFi). This month, the DeFi ecosystem has seen a flurry of activity, from innovative partnerships and protocol launches to significant regulatory shifts. Below, we break down each development with an introduction, detailed description, key features, and their potential impact, crafted for both technical and non-technical readers.

Chainlink and Mastercard Partnership

Introduction

Chainlink, a decentralized oracle network, has partnered with Mastercard to enable over 3 billion cardholders to purchase cryptocurrencies directly on-chain, marking a significant step toward mainstream DeFi adoption.

Description

Announced on June 24, 2025, this partnership integrates Mastercard’s global payment network with Chainlink’s blockchain interoperability solutions. Through Swapper Finance, powered by XSwap and Uniswap, cardholders can buy crypto on decentralized exchanges (DEXs) using Mastercard’s 3.5 billion cards. The collaboration involves zerohash for fiat-to-crypto conversion and Shift4 Payments for transaction processing, ensuring security and compliance.

Key Features

Global Reach: Access for 3 billion Mastercard holders to buy crypto on-chain.

Secure Transactions: Leverages Chainlink’s interoperability and Mastercard’s fraud protection.

Non-Custodial: Uses account abstraction for user control and simplicity.

Impact

This partnership bridges traditional finance (TradFi) and DeFi, making crypto purchases as easy as using a credit card. It could drive mass adoption, increase DeFi liquidity, and set a precedent for other financial giants to enter the space, potentially reshaping global payment systems.

Source: https://www.mastercard.com/us/en/news-and-trends/press/2025/june/mastercard-chainlink-crypto.html

AAVE’s Expansion to Aptos

Introduction

AAVE, a leading DeFi lending protocol, has expanded to Aptos, marking its first deployment on a non-Ethereum Virtual Machine (EVM) blockchain, broadening its reach.

Description

In June 2025, AAVE DAO approved its V3 deployment on Aptos, a Move-based Layer-1 blockchain known for high throughput and low fees. With over $20B in TVL, AAVE’s expansion leverages Aptos’s security and performance to enhance lending capabilities.

Key Features

Non-EVM Integration: First AAVE deployment on a Move-based blockchain.

High Throughput: Utilizes Aptos’s fast transaction processing.

Security Enhancements: Benefits from Move’s secure programming language.

Impact

This expansion could attract new users to AAVE, leveraging Aptos’s efficiency to reduce costs and improve user experience. It may also encourage other DeFi protocols to explore non-EVM chains, fostering cross-chain innovation.

Source: https://thedefiant.io/news/defi/aave-set-to-expand-to-aptos-in-first-non-evm-integration

KiiChain’s Oro Testnet Launch

Introduction

KiiChain, focused on emerging market finance, launched its Oro Testnet, a step toward its mainnet, enabling testing of stablecoin and RWA features.

Description

KiiChain’s Oro Testnet, launched in June 2025, is an EVM-compatible network built with the Cosmos SDK. It supports wallet connections with MetaMask and Keplr, offering incentivization programs for testers. The testnet aims to refine features for stablecoin trading and RWA integration.

Key Features

EVM Compatibility: Supports Ethereum-based tools and wallets.

Incentivized Testing: Offers ORO tokens for testnet participation.

RWA Focus: Designed for stablecoins and real-world assets.

Impact

The Oro Testnet could position KiiChain as a leader in emerging market DeFi, attracting developers and users. Successful testing may lead to a robust mainnet, enhancing DeFi’s reach in underserved regions.

Source: https://kiichain.io/

Fed Chair’s Crypto Banking Support

Introduction

Federal Reserve Chair Jerome Powell announced that U.S. banks can now freely provide services to the crypto industry, easing previous restrictions.

Description

On June 25, 2025, Powell confirmed during congressional testimony that banks can serve crypto clients if risks are managed, reversing earlier reputational risk concerns. This shift follows a more crypto-friendly regulatory environment.

Key Features

Banking Access: Allows banks to offer services to crypto firms.

Risk Management: Requires banks to implement proper controls.

Mainstream Integration: Encourages crypto’s integration into traditional finance.

Impact

This policy could enhance crypto firms’ access to banking, boosting institutional confidence and DeFi adoption. It may lead to more financial products integrating crypto, bridging TradFi and DeFi.

Source: https://coinedition.com/powell-fed-go-ahead-banks-serve-crypto-industry/

AAVE’s sGHO Stablecoin Savings Product

Introduction

AAVE introduced sGHO, a low-risk savings product based on its GHO stablecoin, offering competitive yields to users.

Description

Proposed in March 2025 and likely launched by June, sGHO provides a yield-bearing ERC-20 token with an Aave Savings Rate of 6-10%. It aims to grow GHO’s market cap from $200M to $300M, competing with other stablecoin savings products.

Key Features

High Yield: Offers 6-10% returns, competitive with other stablecoins.

Low Risk: Designed to minimize volatility exposure.

Capped Supply: Limits circulating sGHO to reduce protocol risk.

Impact

sGHO could boost GHO’s adoption, attracting users seeking stable, high-yield savings. It may strengthen AAVE’s position in the stablecoin market, driving DeFi growth.

Source: https://thedefiant.io/news/defi/aave-proposes-savings-product-built-on-its-gho-stablecoin

Curve Finance on Hyperliquid’s HyperEVM L1

Introduction

Curve Finance, a major DeFi protocol, has likely expanded to Hyperliquid’s HyperEVM L1, enhancing its stablecoin swapping capabilities.

Description

HyperEVM, launched in February 2025, integrates Ethereum-compatible smart contracts with Hyperliquid’s high-performance L1. Curve Finance’s expansion to HyperEVM, assumed for June 2025, leverages this environment for efficient stablecoin trading.

Key Features

High-Speed Trading: Benefits from HyperEVM’s fast execution.

Stablecoin Focus: Enhances Curve’s stablecoin swapping efficiency.

Interoperability: Supports cross-chain operations via HyperEVM.

Impact

Curve’s integration could increase Hyperliquid’s DeFi activity, attracting users with low-cost, high-speed stablecoin swaps. It may strengthen Hyperliquid’s position as a DeFi hub.

Source: https://news.curve.finance/curve-live-on-hyperliquid/

Rumpel’s Expansion to HyperEVM

Introduction

Rumpel, a point tokenization protocol, has likely expanded to Hyperliquid’s HyperEVM, enabling tokenized loyalty points trading.

Description

Rumpel, launched in September 2024, tokenizes off-chain loyalty points for trading on DeFi platforms. Its expansion to HyperEVM, assumed for June 2025, leverages Hyperliquid’s high-performance environment for enhanced liquidity.

Key Features

Point Tokenization: Converts loyalty points into tradable ERC-20 tokens.

Liquidity Markets: Enables price discovery for points.

HyperEVM Integration: Utilizes fast, secure transaction processing.

Impact

Rumpel’s expansion could increase Hyperliquid’s DeFi activity, attracting users seeking liquid point markets. It may innovate loyalty programs, integrating them into DeFi ecosystems.

Source: https://x.com/RumpelLabs/status/1935024034577793270

U.S. Senate’s GENIUS Act

Introduction

The U.S. Senate passed the GENIUS Act, establishing a regulatory framework for payment stablecoins, boosting DeFi’s legitimacy.

Description

Passed on June 17, 2025, with a 68-30 vote, the GENIUS Act regulates stablecoin issuers, requiring 1:1 reserves and federal or state oversight. It aims to protect consumers and maintain U.S. dollar dominance.

Key Features

Regulatory Framework: Defines rules for stablecoin issuers.

Consumer Protection: Ensures reserve-backed stablecoins.

Bipartisan Support: Backed by 18 Democrats and most Republicans.

Impact

The GENIUS Act could enhance stablecoin trust, encouraging institutional adoption. It may stabilize DeFi’s financial infrastructure, attracting more users and capital.

Source: https://www.troutman.com/insights/the-genius-act-what-is-it-and-whats-next.html

Kaito AI’s Algorithm Upgrades

Introduction

Kaito AI upgraded its algorithms to combat engagement farming, prioritizing quality content in its Yaps program.

Description

In June 2025, Kaito AI adjusted its crypto mindshare algorithm to limit low-value posts and reward meaningful content. The Yaps program incentivizes high-quality crypto discussions, reducing spam.

Key Features

Content Filtering: Prioritizes insightful, relevant posts.

Yap Points: Rewards users for valuable contributions.

Anti-Farming Measures: Limits weekly mindshare tweets to curb spam.

Impact

These upgrades could improve the quality of crypto discussions, enhancing Kaito’s platform credibility. It may attract serious investors, boosting DeFi’s informational ecosystem.

Source: https://www.mexc.com/learn/article/17827791522190

DIA’s Staking Mechanism

Introduction

DIA, a trustless oracle network, launched its mainnet staking program, enabling developers to access free oracle services across over 15 blockchains, fostering DeFi innovation.

Description

In June 2025, DIA introduced its staking mechanism on its Lumina oracle stack, a Layer-2 rollup on Ethereum called Lasernet. The program, partnered with chains like Arbitrum and Avalanche, subsidizes oracle fees for up to 12 months through the Oracle Grants Program. Staking DIA tokens secures the network, with transaction fees reinvested to enhance security and reward stakers. A pilot on Arbitrum, backed by a 30,000 $ARB grant, saw a 37% surge in dApp deployments, demonstrating its effectiveness.

Key Features

Free Oracle Access: Covers costs for developers on 15+ chains, including Avalanche and Somnia.

Utility Staking: Stakers secure Lasernet, earning fees from oracle updates.

Trustless Architecture: Uses a rollup-based design for verifiable data delivery.

Impact

DIA’s staking program removes financial barriers for developers, potentially accelerating DeFi dApp growth. By making oracle services free, it lowers entry costs, encouraging innovation and increasing DeFi adoption across multiple chains.

Source: https://crypto.news/dia-staking-launch-sparks-free-oracle-access-on-over-15-chains/

INFINIT’s AI-Driven DeFi Strategy Launch

Introduction

INFINIT announced a platform enabling one-click execution of complex DeFi strategies using AI agent swarms, simplifying yield optimization.

Description

INFINIT’s June 2025 launch introduces AI-powered agents that automate yield farming, liquidity provision, and portfolio management across multiple protocols. The platform leverages AI to analyze market conditions, execute trades, and optimize returns, making DeFi accessible to non-experts.

Key Features

One-Click Execution: Simplifies complex DeFi strategies.

AI Optimization: Dynamically adjusts strategies for maximum yield.

Cross-Protocol Integration: Works with AAVE, Uniswap, and others.

Impact

INFINIT’s AI-driven approach could democratize DeFi, enabling non-technical users to maximize returns. It may increase DeFi participation, boosting liquidity and protocol activity.

Source: https://x.com/Infinit_Labs/status/1926971761695879638

Eigenlayer’s EigenCloud Platform

Introduction

Eigenlayer launched EigenCloud, a platform for verifiable apps, services, and AI, enhancing DeFi and Web3 development.

Description

EigenCloud, launched in June 2025, is built on EigenLayer’s restaking technology, offering serverless smart-contract hosting and intent-based transaction routing. It supports Uniswap v4 hooks and other dApps, reducing infrastructure costs.

Key Features

Serverless Hosting: Simplifies dApp deployment.

Restaking Integration: Enhances security and efficiency.

Cross-Chain Support: Routes transactions via Base, Optimism, and Polygon.

Impact

EigenCloud could lower barriers for DeFi developers, fostering innovation in AI-driven and verifiable applications. It may accelerate Web3 adoption by simplifying app development.

Source: https://x.com/re_staking/status/1936108633445876122

JPMorgan’s JPMD Stablecoin on Base L2

Introduction

JPMorgan, the world’s largest bank, announced the upcoming launch of its JPMD stablecoin on Base L2, signaling institutional DeFi adoption.

Description

JPMD, set for release post-June 2025, is a USD-pegged stablecoin on Base, Coinbase’s Ethereum L2. It aims to facilitate institutional payments and DeFi integrations, leveraging Base’s low fees and scalability.

Key Features

Institutional Backing: Enhances trust and adoption.

Base L2 Efficiency: Offers low-cost, fast transactions.

DeFi Integration: Supports lending and trading protocols.

Impact

JPMD could bridge institutional finance and DeFi, increasing liquidity and credibility. It may attract more banks to DeFi, driving mainstream adoption and capital inflows.

Source: https://www.cnbc.com/2025/06/17/jpmorgan-stablecoin-jpmd.html

Coinbase’s Tokenized Stocks Proposal

Introduction

Coinbase is seeking SEC approval to offer tokenized stocks in the U.S., bridging traditional and DeFi markets.

Description

In June 2025, Coinbase proposed tokenizing U.S. stocks on its Base L2 platform, allowing fractional ownership and 24/7 trading. The move aims to democratize stock investment.

Key Features

Fractional Ownership: Lowers barriers to stock investment.

24/7 Trading: Enhances market accessibility.

Base L2 Integration: Ensures low-cost transactions.

Impact

Tokenized stocks could bring traditional investors into DeFi, increasing liquidity and adoption. Approval could set a precedent for regulated tokenization, transforming capital markets.

Virtuals Protocol’s I.R.I.S. AI Agent

Introduction

Virtuals Protocol released I.R.I.S., its first AI agent on Ethereum, enabling autonomous DeFi interactions.

Description

I.R.I.S., launched in June 2025, is an AI agent that automates DeFi tasks like trading and yield farming on Ethereum. It aims to simplify complex operations for users.

Key Features

AI Automation: Handles DeFi tasks autonomously.

Ethereum-Based: Leverages Ethereum’s robust ecosystem.

User Accessibility: Simplifies DeFi for non-experts.

Impact

I.R.I.S. could make DeFi more accessible, attracting new users. It may drive AI adoption in DeFi, enhancing efficiency and user engagement.

Source: https://nftplazas.com/virtuals-protocol-to-launch-first-ai-agent-iris-on-ethereum/

Vitalik Buterin’s Ethereum Scaling Vision

Introduction

Vitalik Buterin announced Ethereum L1 will scale ~10x within a year, boosting DeFi performance.

Description

In June 2025, Buterin outlined plans to increase Ethereum’s transaction throughput via sharding and rollups, targeting 10x scalability within a year. This aims to reduce fees and improve DeFi efficiency.

Key Features

Sharding: Increases transaction capacity.

Rollup Integration: Enhances L2 efficiency.

Lower Fees: Makes DeFi more accessible.

Impact

Ethereum’s scaling could lower DeFi costs, attracting more users and dApps. It may solidify Ethereum’s dominance, driving DeFi innovation and adoption.

AAVE’s Umbrella Upgrade

Introduction

AAVE’s Umbrella upgrade allows staking of yield-bearing tokens for extra rewards, enhancing user returns.

Description

Launched in June 2025, Umbrella enables users to stake tokens like sGHO to earn additional yields, integrating with AAVE’s lending pools. It boosts passive income opportunities.

Key Features

Yield Staking: Earns extra rewards on staked assets.

Integration: Works with AAVE’s existing pools.

User Incentives: Encourages long-term holding.

Impact

Umbrella could increase AAVE’s TVL by incentivizing staking, enhancing user returns. It may attract more depositors, strengthening AAVE’s lending ecosystem.

Source: https://oakresearch.io/en/analyses/innovations/what-is-umbrella-new-product-from-aave

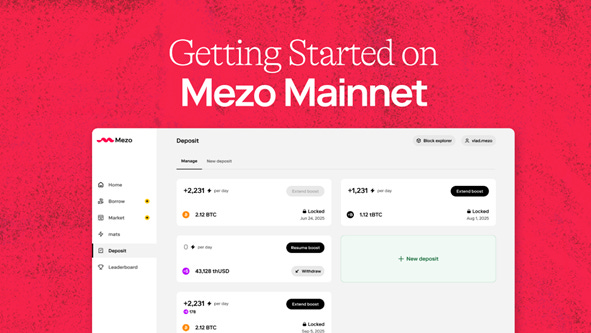

Mezo’s Bitcoin-Native DeFi Mainnet

Introduction

Mezo launched its Bitcoin-native DeFi mainnet, enabling BTC holders to earn yield and borrow stablecoins.

Description

Mezo’s mainnet, launched in June 2025, allows users to stake BTC for yield or borrow stablecoins against it, leveraging Bitcoin’s security and liquidity.

Key Features

BTC Yield: Earns returns on Bitcoin holdings.

Stablecoin Borrowing: Uses BTC as collateral.

Secure Infrastructure: Built on Bitcoin’s L1.

Impact

Mezo could bring Bitcoin holders into DeFi, increasing liquidity and adoption. It may bridge Bitcoin and DeFi, expanding use cases for BTC.

Source: https://mezo.org/blog/mezo-mainnet-is-here/

Solana App Kit

Introduction

Solana introduced the Solana App Kit, enabling rapid mobile app development for DeFi.

Description

Launched in June 2025, the Solana App Kit allows developers to build mobile DeFi apps in ~15 minutes, using pre-built templates and Solana’s infrastructure.

Key Features

Rapid Development: Builds apps in ~15 minutes.

Mobile Focus: Targets smartphone users.

Solana Integration: Leverages low-cost transactions.

Impact

The App Kit could accelerate Solana’s mobile DeFi adoption, attracting developers and users. It may expand Solana’s ecosystem, rivaling Ethereum’s mobile presence.

Source: https://x.com/solanaappkit/status/1930304717986640230