APUBCC Bulletin #4

Decentralized Finance (DeFi) is transforming how we interact with money, offering tools to lend, borrow, trade, and invest without traditional banks. Last month, we’re seeing exciting advancements that make DeFi faster, more user-friendly, and connected to mainstream finance. From new blockchain technologies to AI-driven apps and regulatory progress, these updates are shaping the future of finance. Whether you're a crypto newbie or a seasoned investor, this newsletter breaks down the latest trends in simple terms while diving deep into their significance.

Why It Matters?

These changes make DeFi easier to use, more efficient, and trusted by bigger players like FIFA and J.P. Morgan. They could bring DeFi to millions more people, but challenges like technical risks and unclear regulations mean we need to stay informed.

What to Watch?

Look out for how these innovations drive DeFi adoption, improve user experiences, and navigate regulatory hurdles. From tokenized stocks to instant transactions, DeFi is blending with everyday finance—let’s explore how!

Solana’s Anza Introduces Alpenglow Consensus Mechanism

Introduction

Solana is already known for super-fast transactions, but it’s about to get even faster. Anza, a research firm focused on Solana, has introduced Alpenglow, a new system that makes transactions confirm almost instantly—think milliseconds, not seconds. This upgrade could make Solana a go-to blockchain for apps needing real-time speed, like trading or gaming.

Description

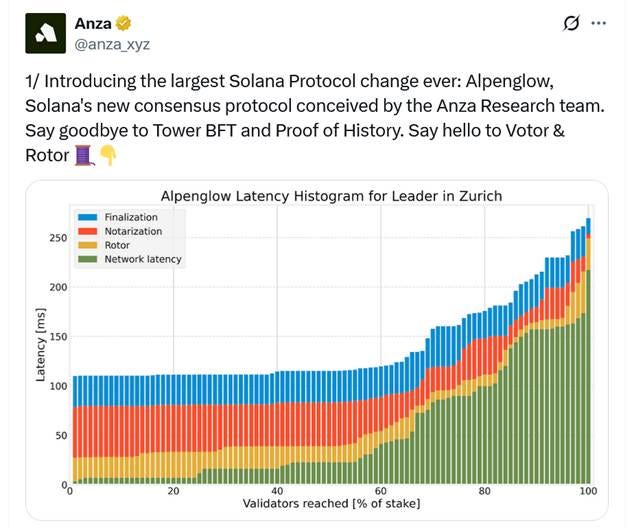

Alpenglow replaces Solana’s existing Proof-of-History and TowerBFT systems with two new components: Votor (for finalizing transactions) and Rotor (for sharing data across the network). This reduces transaction finality—the time it takes for a transaction to be permanently recorded—from 12.8 seconds to 100–150 milliseconds. That’s 100 times faster, making Solana as quick as centralized platforms like Visa, but without a central authority. This is a game-changer for DeFi apps needing instant confirmations.

Key Features

Ultra-Fast Finality: Transactions confirm in 100–150 milliseconds, enabling real-time DeFi applications.

Decentralized Design: Alpenglow maintains Solana’s security and decentralization, avoiding reliance on a single entity.

Scalability Boost: Supports thousands of transactions per second, ideal for high-demand platforms.

Developer-Friendly: Compatible with Solana’s existing tools, making it easy for developers to build on Alpenglow.

Impact

For everyday users, Alpenglow means DeFi apps on Solana—like trading or lending platforms—will feel as fast as traditional apps. Businesses can build real-time payment systems or games, attracting more users. However, super-fast systems can face challenges like network congestion or higher hardware demands for validators, which could raise costs. Still, Alpenglow positions Solana as a leader in high-speed DeFi, potentially outpacing competitors like Ethereum.

Source: Anza’s Alpenglow Proposal

INFINIT’s AI-Powered DeFi Upgrade

Introduction

Navigating DeFi can feel like solving a puzzle, with countless protocols and strategies. INFINIT’s new AI-powered upgrade, INFINIT Intelligence, acts like a personal guide, tailoring DeFi recommendations to your needs. Whether you’re a beginner or a pro, this tool makes finding and executing DeFi opportunities easier than ever.

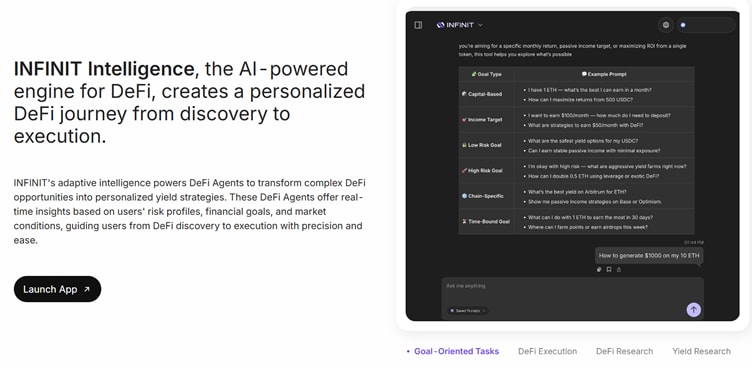

Description

INFINIT Intelligence uses artificial intelligence to analyze your wallet activity, financial goals, and market trends. It then suggests personalized DeFi strategies, such as yield farming on Aave or trading on Uniswap, and executes them on-chain. The app supports multiple blockchains, making it a one-stop shop for DeFi. By leveraging AI, INFINIT simplifies complex decisions, like choosing the best liquidity pool or managing risk, which is especially helpful for newcomers.

Key Features

Personalized Recommendations: AI tailors strategies based on your wallet and goals, like maximizing yield or minimizing risk.

Multi-Chain Support: Works with Ethereum, Solana, and others, letting you explore DeFi across ecosystems.

Automated Execution: Executes trades or investments directly on-chain, saving time and reducing errors.

User-Friendly Interface: Designed for beginners, with clear guidance and minimal jargon.

Impact

INFINIT Intelligence lowers the barrier to DeFi, making it accessible to non-technical users who might feel overwhelmed. For advanced users, it saves time by automating complex strategies. The AI’s ability to adapt to market changes could improve returns, but users should be cautious of over-reliance on automation, as AI predictions aren’t foolproof. This upgrade could drive mainstream DeFi adoption by simplifying the user experience.

Source: INFINIT Intelligence

Chainlink’s CCIP Goes Live on Solana

Introduction

Imagine moving money or data between blockchains as easily as sending an email. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is now live on Solana, making this possible. This connection lets Solana interact with other blockchains like Ethereum, unlocking billions in assets for DeFi users.

Description

CCIP is a secure system for transferring assets and data across different blockchains. Its launch on Solana, a non-EVM chain, is a big deal—it’s the first time CCIP supports a blockchain outside Ethereum’s ecosystem. This enables Solana users to move tokens or execute smart contracts with chains like BNB Chain or Avalanche. CCIP’s security, backed by Chainlink’s oracle network, ensures safe and reliable transfers, which is critical for DeFi and institutional use cases.

Key Features

Cross-Chain Transfers: Move tokens or data between Solana and other blockchains securely.

Institutional-Grade Security: Uses Chainlink’s audited oracle network to prevent hacks or errors.

$19 Billion Unlocked: Enables access to assets across multiple chains, boosting Solana’s DeFi ecosystem.

Smart Contract Integration: Supports complex cross-chain applications, like lending or trading.

Impact

For users, CCIP means more flexibility to use assets across blockchains without relying on risky bridges. For businesses, it opens doors to build apps that combine Solana’s speed with Ethereum’s liquidity. This could attract traditional finance players to Solana, but challenges like cross-chain compatibility bugs or high gas fees on other chains could slow adoption. CCIP’s launch is a step toward a unified DeFi ecosystem.

Source: Chainlink CCIP on Solana

FIFA Launches L1 Blockchain on Avalanche

Introduction

Soccer fans, get ready—FIFA is diving into blockchain! Partnering with Avalanche, FIFA is launching its own Layer 1 blockchain to power digital collectibles and fan experiences. This move brings DeFi and Web3 to billions of sports fans worldwide.

Description

The FIFA Blockchain, built on Avalanche, is a custom Layer 1 designed for speed and scalability. It will host digital collectibles like NFTs for iconic soccer moments and create interactive fan experiences, such as virtual events or rewards programs. Avalanche’s high throughput and EVM compatibility make it ideal for handling FIFA’s massive global audience. This partnership shows how blockchains can go beyond finance to transform entertainment.

Key Features

Digital Collectibles: Fans can own unique NFTs tied to FIFA events, like World Cup highlights.

Fan Engagement: Offers immersive experiences, such as virtual stadiums or loyalty rewards.

Scalable Infrastructure: Avalanche handles millions of transactions, supporting FIFA’s 5 billion fans.

Developer-Friendly: EVM compatibility lets developers build apps for the FIFA ecosystem.

Impact

This initiative introduces blockchain to a mainstream audience, making DeFi concepts like NFTs more familiar. Fans can trade collectibles or earn rewards, potentially exploring other DeFi tools. For Avalanche, hosting FIFA’s blockchain boosts its credibility and could attract more projects. However, mass adoption depends on user education and ensuring the platform is secure against hacks, a common blockchain challenge.

Source: FIFA Blockchain on Avalanche

Aave Labs Proposes GHO Borrowing Against Uniswap V4 LP Positions

Introduction

Want to borrow money using your DeFi investments as collateral? Aave Labs is proposing a new feature to let users borrow its GHO stablecoin using Uniswap V4 liquidity provider (LP) tokens. This could make DeFi lending more flexible and rewarding.

Description

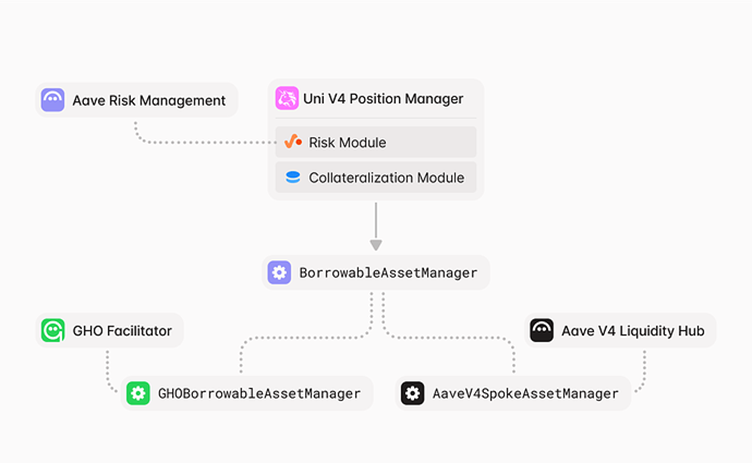

Aave is a leading DeFi lending platform, and GHO is its dollar-pegged stablecoin. Uniswap V4 is the latest version of the popular decentralized exchange, where users provide liquidity to earn fees. Aave’s proposal lets users use their Uniswap V4 LP tokens—proof of their investment in liquidity pools—as collateral to borrow GHO. A specialized Position Manager smart contract makes this possible, and revenue from the feature will be shared between Aave and Uniswap’s DAOs.

Key Features

New Collateral Type: Use Uniswap V4 LP tokens to borrow GHO, expanding Aave’s collateral options.

Revenue Sharing: Aave and Uniswap DAOs split profits, aligning incentives.

Capital Efficiency: Users can earn fees from Uniswap while borrowing against those assets.

Secure Design: The Position Manager ensures safe and transparent collateral management.

Impact

This feature lets users unlock the value of their Uniswap positions without selling, boosting DeFi’s flexibility. For non-technical users, it’s like using a stock portfolio to get a loan without selling shares. It could deepen Aave and Uniswap’s collaboration, driving innovation. However, risks like liquidity pool volatility or smart contract bugs need careful monitoring to protect users.

Source: Aave’s GHO Proposal

Liquity V2 Launches on Ethereum L1

Introduction

Borrowing in DeFi just got more flexible with Liquity V2, a new lending protocol on Ethereum. It lets users set their own interest rates and use multiple types of collateral, making loans more tailored to individual needs.

Description

Liquity V2 is an upgraded version of Liquity, a protocol for borrowing stablecoins against collateral like ETH. The new version introduces BOLD, a stablecoin with improved stability, and lets users choose their interest rates for more control. It also supports multiple collaterals, like staked ETH from Lido or Rocket Pool, unlike V1’s ETH-only model. Built on Ethereum’s secure Layer 1, Liquity V2 offers low-cost, decentralized lending.

Key Features

User-Set Interest Rates: Borrowers pick their rates, balancing cost and stability.

Multi-Collateral Support: Use ETH, Lido stETH, or Rocket Pool rETH as collateral.

BOLD Stablecoin: Designed for better peg stability and real yield.

High Security: Leverages Ethereum’s robust network to protect funds.

Impact

Liquity V2 makes borrowing more user-friendly, letting people customize loans like choosing a mortgage rate. This could attract more DeFi users, especially those wary of high fees. Its multi-collateral approach diversifies risk, but users must understand market volatility, as collateral values can fluctuate. Liquity V2 strengthens Ethereum’s DeFi ecosystem, competing with platforms like Aave.

Source: Liquity V2 Launch

Chainlink, J.P. Morgan, and Ondo Finance Enable Cross-Chain Treasury Settlement

Introduction

Big banks are joining DeFi! Chainlink, J.P. Morgan, and Ondo Finance have teamed up to settle tokenized U.S. Treasuries on a public blockchain, a first for J.P. Morgan. This shows how DeFi is merging with traditional finance.

Description

The collaboration used Chainlink’s CCIP and J.P. Morgan’s Kinexys Digital Payments network to settle Ondo’s OUSG token (representing U.S. Treasuries) on Ondo Chain’s testnet. The transaction followed a Delivery versus Payment model, ensuring both sides deliver simultaneously to reduce risk. This is a milestone for tokenized real-world assets (RWAs), bringing secure, blockchain-based finance to institutions.

Key Features

Tokenized Treasuries: OUSG represents U.S. Treasuries, offering stable, yield-generating assets.

Secure Settlement: CCIP ensures safe cross-chain transfers, verified by Chainlink’s oracles.

Institutional Backing: J.P. Morgan’s involvement adds credibility to DeFi.

Risk Reduction: DvP model minimizes counterparty risk in transactions.

Impact

This partnership bridges DeFi and Wall Street, making tokenized assets more accessible to banks and investors. For users, it means safer ways to invest in stable assets like Treasuries. However, scaling this to mainnet and ensuring regulatory compliance will be key challenges. This move could accelerate RWA adoption, transforming how we invest.

Source: Cross-Chain Treasury Settlement

Superstate’s Opening Bell for Tokenized Equities

Introduction

Stocks on the blockchain? Superstate’s Opening Bell platform lets companies issue tokenized equities on Ethereum and Solana, enabling 24/7 trading and DeFi integration. This could change how we buy and sell shares.

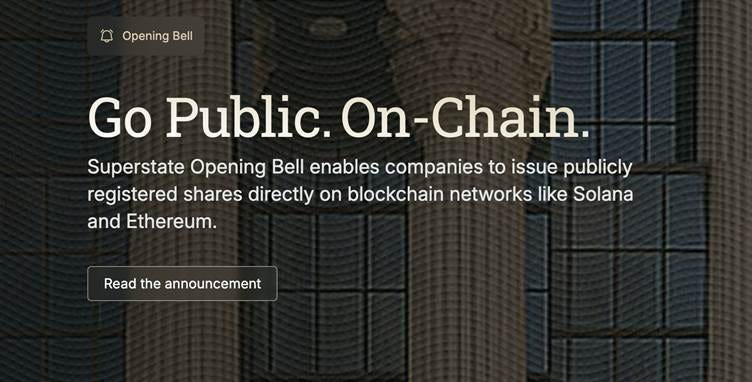

Description

Opening Bell allows companies to issue SEC-registered shares as tokens on public blockchains. The first participant, SOL Strategies, issued tokenized shares that can be traded anytime, unlike traditional stock markets. These tokens can also be used in DeFi, like as collateral for loans. Superstate’s platform leverages Ethereum’s security and Solana’s speed to create a new equity market.

Key Features

Tokenized Shares: Companies issue shares as blockchain tokens, tradable 24/7.

DeFi Integration: Use shares in lending or yield farming on Ethereum and Solana.

SEC Compliance: Ensures legal compliance for investor protection.

Real-Time Settlement: Transactions settle instantly, unlike traditional markets.

Impact

Opening Bell makes stock trading more accessible, letting anyone with a wallet trade anytime. For companies, it’s a new way to raise capital. For DeFi users, tokenized shares open new investment opportunities. However, regulatory hurdles and market volatility could slow adoption, and investors must understand blockchain risks. This platform could redefine equity markets.

Source: Superstate’s Opening Bell

Arbitrum DAO Allocates 35M ARB for Tokenized US Treasuries

Introduction

Arbitrum, a fast Ethereum Layer 2, is investing big in tokenized U.S. Treasuries. Its DAO has approved 35 million ARB tokens (worth ~$11.6 million) to diversify its treasury with stable, yield-generating assets.

Description

The Stable Treasury Endowment Program (STEP) 2.0 allocates 35M ARB to tokenized Treasuries from Franklin Templeton (FOBXX), Spiko (USTBL), and WisdomTree (WTGXX). These tokens represent U.S. Treasuries, offering low-risk yields. Arbitrum, known for low-cost DeFi, uses this to strengthen its treasury and support ecosystem growth, like funding dApps or grants.

Key Features

Diversified Treasury: 35% to FOBXX, 35% to USTBL, 30% to WTGXX for balanced investment.

Stable Yields: Treasuries provide predictable returns, unlike volatile crypto assets.

Ecosystem Support: Funds can fuel Arbitrum’s DeFi and developer programs.

Community Governance: DAO members voted to approve the allocation.

Impact

This move makes Arbitrum’s treasury more stable, reassuring users and developers. For non-technical audiences, it’s like a bank investing in safe bonds to ensure long-term growth. It also boosts the tokenized RWA market, encouraging other DAOs to follow. However, market risks or low yields could limit returns, and governance disputes might arise. Arbitrum’s leadership in RWAs strengthens its DeFi position.

Source: Arbitrum DAO’s Allocation

Rumpel’s Auto-Seller for Airdrop Points

Introduction

Airdrops often give users “points” that are hard to use. Rumpel Labs’ Auto-Seller lets you turn these points into cash or tokens automatically, making airdrops more valuable and user-friendly.

Description

Rumpel’s Auto-Seller converts airdrop points from projects like Ethena or Zircuit into Rumpel Point Tokens, which can be sold instantly. This solves the problem of illiquid points, which often lock up value until a project’s token launch. Built on Ethereum, the Auto-Seller uses smart contracts to ensure secure, transparent sales, benefiting both users and project issuers.

Key Features

Instant Liquidity: Sell airdrop points without waiting for token launches.

Supported Projects: Works with Ethena, Symbiotic, Zircuit, and others.

Secure Transactions: Smart contracts ensure fair and transparent sales.

User-Friendly: Simplifies the process for non-technical users.

Impact

For users, Auto-Seller unlocks the value of airdrop points, making DeFi rewards more tangible. Projects benefit by keeping users engaged, as points become usable sooner. However, point volatility or low market demand could affect returns, and users must trust Rumpel’s contracts. This innovation could set a new standard for airdrop management.

Source: Rumpel’s Auto-Seller

Coinbase Joins S&P 500 as First Crypto Firm

Introduction

Crypto is hitting the big leagues! Coinbase, a leading crypto exchange, is joining the S&P 500, a major stock index. As the first crypto-only company in the index, this is a huge step for DeFi and crypto’s mainstream acceptance.

Description

Coinbase replaces Discover Financial Services in the S&P 500, reflecting its growing influence. The exchange supports trading, staking, and DeFi integrations, serving millions of users. Its inclusion signals that traditional finance sees crypto as a legitimate industry. However, some investors worry about crypto’s volatility impacting Coinbase’s stock performance in the index.

Key Features

Historic Inclusion: First crypto-focused firm in the S&P 500.

Mainstream Credibility: Validates crypto’s role in global finance.

Broad Services: Coinbase supports DeFi, trading, and custody solutions.

Market Impact: Expected to drive demand for Coinbase’s stock.

Impact

For users, Coinbase’s S&P 500 status builds trust in crypto, encouraging more people to explore DeFi. For the industry, it attracts institutional investors, potentially increasing liquidity. However, Coinbase’s stock may face volatility tied to crypto markets, and regulatory scrutiny could intensify. This milestone marks a turning point for DeFi’s integration with traditional finance.

Source: Coinbase Joins S&P 500

Conclusion

May 2025 is a pivotal moment for DeFi, with innovations making it faster, more accessible, and integrated with mainstream finance. From Solana’s lightning-fast transactions to FIFA’s blockchain and Coinbase’s S&P 500 entry, DeFi is reaching new heights. For users, these changes mean easier, safer ways to invest and manage money. But challenges like technical risks, regulatory debates, and market volatility remind us to stay vigilant. Keep exploring DeFi—it’s reshaping finance for everyone!